A few years ago*, I purchased (invested in?) a few Series I Savings Bonds. It wasn’t a significant sum but I wanted to see what it was like.

Series I Savings Bonds are inflation-adjusted savings bonds that have a fixed interest rate and an inflation rate that is adjusted twice a year, in May and November. With inflation so low for so many years, oftentimes the rate is quite low.

The major differences between Series EE and Series I bonds are the interest rate. With Series EE, you get a fixed interest rate for the first 20 years then the rate can be adjusted. With Series I, you get the inflation-adjusted rate (technically, a fixed rate plus an inflation-adjusted rate). Series EE bonds have another key difference – they are guaranteed to double after 20 years no matter what. This means you are guaranteed a 3.5% rate of return.

It’s really easy to buy Treasury bonds and bills, so if that’s ever deterred you, don’t let it!

(also, interest from savings bonds is tax-exempt at the State level and below)

Table of Contents

Check the Current Value of Your Savings Bond

In 2012, the Treasury stopped selling paper bonds and went completely electronic. If you have a bond after that time period, you probably also have a TreasuryDirect.gov account that you can use to check the current value of your electronic savings bonds. The easiest way to find the value of your bonds is to log in and look!

It’s a silly answer but it might spur you to find out your TreasuryDirect login details. 🙂

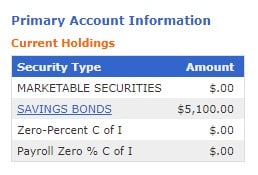

Once you log in, all your bonds will be listed under Current Holdings:

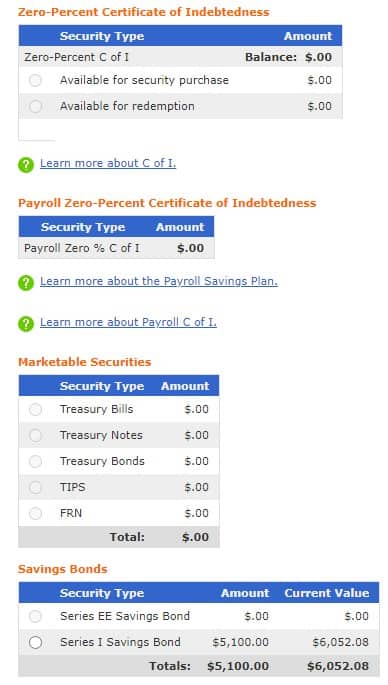

Click Savings Bonds and it’ll show all your bonds:

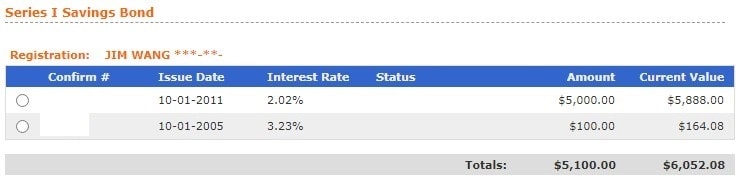

Here’s where it’s less clear, click the circle next to Series I Savings Bond and click Submit to see your bonds itemized out:

If you have a bond from before 2012, I highly recommend that you convert it to an electronic bond just for the ease of management.

How to Cash in a Paper Savings Bond

If you want to cash in your paper savings bond, it’s easy. Since the Treasury hasn’t issued a paper savings bond since 2012, you’re way outside the 1 year period (you can’t redeem a savings bond within the first 12 months), so you can redeem it.

There’s also a three-month penalty if you cash in a bond before 5 years – again since they haven’t issued a paper bond since 2012 you’re in the clear here too.

Just take the paper bond to your bank or credit union. If you don’t have one with a physical location, call local banks to see if they will cash them for non-customers.

Make sure you bring:

- The paper savings bond,

- Identification like a driver’s license or passport,

- A copy of the owner’s death certificate if you are a beneficiary.

It’s super easy.

How to Convert Your Paper Bond to an Electronic Bond

All bonds can now be managed through TreasuryDirect, the Treasury’s online portal.

There are three steps to this process:

- Register for an account at TreasuryDirect.gov,

- Create a “Conversion Linked Account,”

- Convert your paper bonds and put them into the Conversion Linked Account.

1. Register.

2. Create a “Conversion Linked Account”

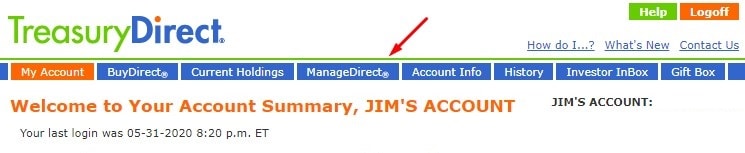

Log in and look for ManageDirect in the top menu:

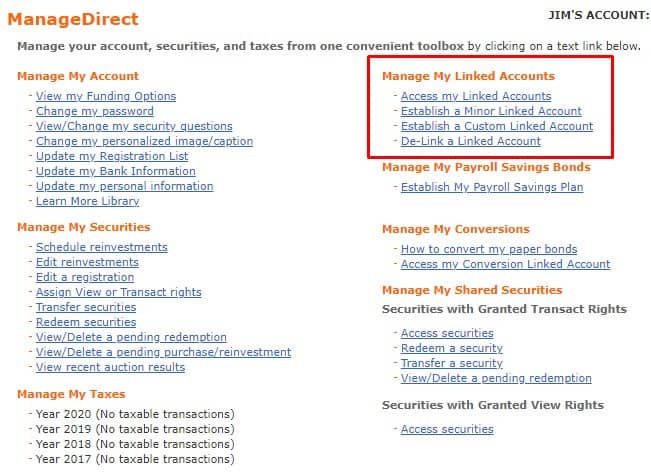

Then look for “Establish a Conversion Linked Account,” it’ll be around here (mine isn’t there anymore because I set it up a while ago):

Go through the process of creating a Conversion Linked Account – this is the (sub)account you’ll use to manage all the converted bonds. It’s separate from the account you use to manage bonds that were always electronic. In my case, my regular account starts with a Y and my conversion linked account starts with a J.

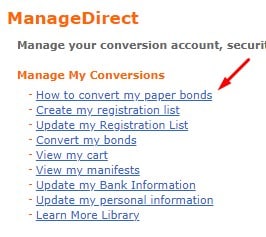

Once you access your Conversion Linked Account, which all looks the same except at the top right you’ll see >> My Converted Bonds followed by your account number, click on “ManageDirect” in the menu.

Now, under Manage My Conversions, there’s an option to convert your paper bonds:

3. Convert your paper bonds:

The full instructions will appear after you click on “How to Conver My Paper Bonds” but essentially you:

- Create a registration list to include all your bonds (do not sign the back!),

- Add those bonds to your Conversion Linked Account (do not sign the back!),

- Print a manifest of your bonds to mail into the Treasury (do not sign the back!),

- Mail the bonds with the manifest.

If any of the bonds have fully matured, you’ll get a 0% Certificate of Indebtedness (C of I) put into your main account.

What is a Patriot Bond?

After 9/11, the Treasury Department started calling the Series EE bonds a name – Patriot Bonds. They were paper Series EE bonds that had “Patriot Bond” typed on the front of it and for all practical purposes, they are Series EE bonds.

They are to treated like all other Series EE bonds.

How to Calculate The Current Value of a Savings Bond

If you have the rough details of a bond, you may be happy just calculating it rather than looking it up.

Maybe you want to know “What’s my savings bond worth?” but you don’t want to know so badly as to go through registering, adding it, etc. I get it.

It’s just faster to use a savings bond calculator.

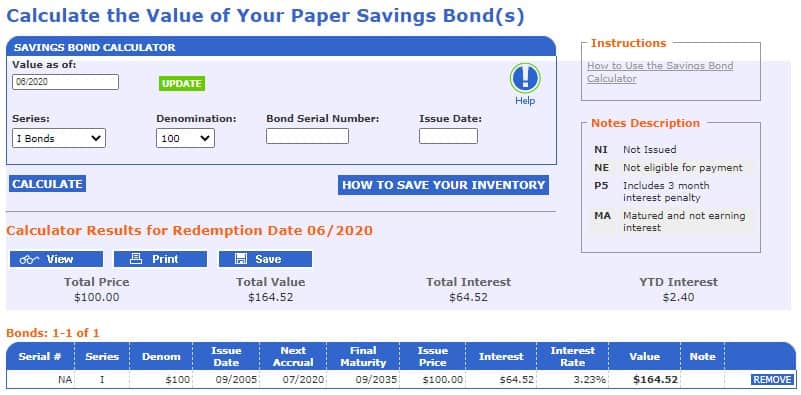

The Treasury also has this very useful savings bond calculator for calculating the value of your Series EE, Series I, Series E, and Savings Notes. It asks for:

- Series of the bond – so EE, I, E, or Savings Notes

- The denomination – this is the face value of the bond

- Bond series number – this is optional

- Issue date – if you only put a year, it assumes February of that year

I dipped my toe into the Series I world with a $100 bond I purchased on September 2005:

My $100 bond now has a value of $164.52!

(when I logged in, the value was shown as $164.08 – close enough)

As you click Calculate, it’ll calculate the values and add them as individual rows to the list. You can remove those rows by clicking a small blue Remove button on the right. It looks like it was made in 2001 but it works great.

How to Calculate the Future Value of a Bond

This is a little trickier because many of the most appealing bonds are inflation-adjusted and it’s hard to know what the CPI will be in the future. Ask one expert and they’ll tell you that inflation is historically 3% but ask another and they’ll say that the Federal Reserve has been printing so much money we risk deflation.

The Treasury Direct calculator will give you the value into the future for as long as the interest rate is set. For example, since the inflation-adjusted rate changes twice a year, you can find the value of a bond up until the next rate change.

Otherwise, if you want to calculate it then you will have to make assumptions and just treat it like a bank account that accrues interest monthly.

* After writing this post, a few years in the first sentence seems to actually be fifteen!

Should You Redeem Your Series I Bonds?

This question is a little trickier to answer because it depends on the bond and what your other investment options are. The best way to decide if you should redeem your Series I bond is to check their current interest rate and see what other options you have.

If you have a Series I bond that’s less than 5 years old, you can use Eyebonds.info to see your current interest rate and the three months of interest you’d have to surrender. That can help you decide.

How much is a $100 savings bond worth after 30 years?

It depends!

Because the rate of return on your bond will vary, you need to check online. Or calculate it using this calculator for paper bonds.

Some bond types have a minimum rate of return though. For example, the Series EE bonds will double in value in 20 years. The Series I bond does not have this feature.

Did Your Bond Mature?

If your bond has matured and you’re cashing it in, you might want to put it in something with a similar risk profile. While nothing is as safe as a savings bond, since it’s backed by the full faith and credit of the United States Government, there are some investments that are pretty close.

We list a few safe investments options here that might make sense for your situation.

Todd says

Good write up. The treasury direct web site is ultra confusing.. not user friendly!

Nate says

The bond calculator on the treasury website is non-functional today. I was greeted with a

“We’re sorry…

We may have moved or retired the web page.”

at: https://www.treasurydirect.gov/BC/SBCPrice

So you may want to edit your instructions!

Try it again because it works for me – thanks!

Kimberly says

Thank you for you informative article on this information. I in fact, stumbled along this article in particular because I was interested in finding out how to go about finding a savings bond in my name from around 1999-2000. I am unsure of which year exactly, as it was a prize for an academic challenge and was then retained by my adoptive mother. It’s been years since and I have no idea of even know what type of bond it was. Is there a way I can go about figuring that out or will that information be available to me once I go to Treasury direct.hov and establish an account. I know I need to convert this bond to electronic since it was gifted to me well before the date in which the paper bonds were no longer distributed. I am just curious on how I go about finding information on the bond such as the type it series of the bond. If you have any suggestions please share with me your opinions. Thank you again for such an informative and easy to follow article with visible examples that may be used to follow the steps given.