We all have cognitive biases.

What’s funny about a good cognitive bias is that when you read about them they make perfect sense. I totally understand how survivorship bias works and what to look out for.

But when those biases influence you, you usually aren’t aware of their impact. Since you don’t know you’re being affected, it’s hard to counter it. Sometimes, it’s an inclination that is so slight that it’s imperceptible to your conscious mind.

So, while you try to be aware of them, they still creep in.

This is why habits are so important. They’re like biases in your behavior that you put into place on purpose. You may put on workout clothes at the start of the day because it’ll remind you to work out. You may meal plan healthy meals and have the groceries delivered so you are primed to cook them.

Today, I want to share a few ways I’ve used my cognitive biases in my favor to help me become better with my money and my life.

Table of Contents

Sunk Cost Fallacy

Have you heard of the sunk cost fallacy? It’s the idea that you keep going through with something because of all the “sunk cost” you’ve already paid. This could be literal money but it can also be time. We may finish a movie because we started it… even if we absolutely hate it. We may finish a meal because we paid for it… even if you don’t enjoy it.

By paying up front for something, we’re more likely to keep using it because we have already paid so much for it.

Around the middle of 2020, during the pandemic, we purchased a Peloton Tread. I used one at a friend’s house and I thought the design was great. I didn’t like treadmills because I hated the belt. The Tread was great because it had literal treads, like a tank, so running on it felt a lot better.

I started running years ago and it’s something I enjoy. But with all of our kids home and our local gym closed, I had no convenient way to work out. Getting a treadmill at home gave me a chance to pick up running again without having to leave the house.

It’s a $4,000 piece of gym equipment and extremely expensive. You can get a regular treadmill for under $1,000. Plus the digital subscription is an additional $40 a month. (it’s offset slightly by a benefit from the Chase Sapphire Preferred card)

By spending this money up front, I’m now committed to using it because I’ve spent so much. I can’t spend $4,000 on something and not use it. And I have for over a year.

You see this play out most often with sunglasses. I have several friends who have bought expensive $100 sunglasses because they know they will take care of them. When you’re used to paying $10 or $15, you treat them like $10 or $15 sunglasses – you toss them around and treat them as practically disposable. You wouldn’t dare do that with $100 sunglasses… which is why people get them. You take care of your nice things!

Status Quo Bias

I love the status quo bias. I know that if I set something up for myself right now, there’s a very good chance I won’t mess with it for years.

When I started working at Northrop Grumman, I set my contribution to my 401(k) at 6%. The company completely matched my first 2% in contributions and then matched 50% of my next 4%, so this way I got a 3% match on a 6% contribution.

Boom, set it and forget it.

When I started working for myself and earning a little bit more, I started making a regular monthly contribution to a brokerage account. I was doing this manually and I was inconsistent. Sometimes I’d do it on the 1st of the month, sometimes it was a weekend so I’d forget until like mid-month; it was a mess.

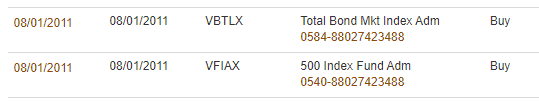

Then I realized I could schedule automated transfers into my Vanguard account just as easily as any other contribution. Boom – it’s now done for me automatically and I haven’t thought about it for over a decade. (I just checked, I literally set it up August 2011)

I automate as much as I can and I definitely make sure “good” financial behaviors are automated so I don’t mess it up being human.

Hyperbolic Discounting

Hyperbolic discounting is great – think of it like the reverse Marshmallow test. This is when you prefer a smaller and sooner reward over a larger but delayed reward.

Except instead of rewards, I do this with any type of work.

Tori Dunlap of Her First 100K will, on Twitter, routinely just tweet out that now is a good time to transfer $20 to savings:

$20 feels like a small amount. Feels insignificant. It feels like a “small and sooner” good act vs. something bigger and later. Shouldn’t you just wait until you can transfer something bigger?

No! Just transfer it!

Lean into the small and sooner. Reward yourself with good money steps. You can always do that bigger and better something else later too.

Reciprocation

Reciprocation is the first principle of influence proposed by Robert Cialdini, author of the famous book Influence: The Psychology of Persuasion. Not quite a bias in thinking but one of action.

It essentially says people like to repay favors. If you do a favor for someone else, they’re more likely to do a favor for you. I buy you lunch, you want to buy me lunch.

When it comes to running a business, success relies quite a bit on relationships and knowledge. There are quite a few unknown unknowns, especially with businesses that operate in a fast moving environment like the internet.

To cultivate these relationships, I try to do favors, big and small, for others because I believe the principle of reciprocation means I’ll probably be rewarded down the road.

I don’t have a specific reward in mind and I don’t do it for the reward. I do it to try to build that relationship because I see these folks are my peers and, in many cases, they’re my friends too.

While I can never match a favor to a favor, nor would I ever want to, I do know that I probably wouldn’t be as successful as if I didn’t employ this strategy.

In the end, it’s just being nice and that’s never bad!

As an aside: Personally, I believe that if someone ever sends you an opportunity of any kind with a note that says “thought of you,” I believe it’s reciprocation working its delightful magic. It’s not that they want to pay you back by telling you about this opportunity, it’s that they really did think of you and that’s because they like you and wanted you to succeed. Maybe that’s because you did them favors or helped them out or maybe you’re just awesome – in the end, does it really matter?

Loss Aversion Bias

Loss aversion is exactly what it sounds like – an aversion to loss.

This most acutely happens in investing when you might see the news reporting massive losses in the stock market and a sea of red numbers. When it comes to individual investments and deciding when to cut your losses, loss aversion can be bad. You might hold onto something in the hopes it turns profitable. I’m not talking about that.

I’m talking about your long-term holdings in retirement accounts and other “buckets” that you don’t look to touch for at least ten years. Short-term fluctuations in the market can be painful to look at but if you sell now and try to “cut your losses,” you’ll likely miss the rebound. If these are funds you don’t need for 10+ years, there’s a near-certain chance the assets will recover.

So when the market gets crazy, I go away. 🙂

Spotlight Effect

The spotlight effect is when we overestimate how much people pay attention to us and what we’re doing. Social media makes this worse because we see what others are doing and think everyone is watching what we’re doing.

In reality, we only see what others are sharing and we only see that because we were looking!

This is why, in most cases, you will only see someone’s greatest hits. People don’t like to share when they stumble.

Some people like the spotlight. Others, like myself, don’t care for it.

Why? Because people who need money tend to ask for it from people who have money. Can I borrow some cash? Do you want to invest in my new business? I’ll pay you back with interest! I’ll this and that. It’s a headache you don’t want to have. And that’s just the benign stuff.

This is why we try to maintain stealth wealth. We aren’t ostentatious because I simply do not want the attention. We’re “financially independent wealthy” but we’re not “private jet wealthy” or “travel to space wealthy.” We could afford a bigger house or a suite of luxury cars, but… why?

We prefer to keep it invested so that we can control our time.

Instead, we indulge in areas that are important to us but would be super boring on social media. No one really cares that we mostly buy organic produce but that stuff is pricey!

I use the spotlight effect, or rather my desire to avoid the spotlight, to remind me that no one cares how I spend my money. Even if I did, and overspent, no one is really watching.

Optimism Bias

The optimism bias is what it sounds like – a tendency to be optimistic.

This bias led me to decline comprehensive insurance on my first two cars once they were old enough that self-insurance was a viable option. Self-insurance can work well when the probability of an adverse outcome is low (especially if I think the probability is tiny given my optimism!) and the cost is also relatively low.

I wouldn’t do this with my house (I have no choice, the mortgage company requires it). Or with umbrella insurance (I can’t be optimistic because I can’t possibly know all the potential claims).

But with situations where the cost of an adverse outcome is relatively low, I “take the risk” of self-insuring. I stopped after my first two cars and consider myself “up” against the house. 🙂

Finally, a bias towards optimism keeps me invested in me. I keep working on projects I find interesting and fun because I think my future, and that of my family and loved ones, is bright. I will continue working hard because I think that hard work will translate into a better life.

The past few years have tested that worldview but I remain optimistic… and it has yet to fail me!

Mr C says

Great take on using biases in our favor!

Thanks!

Dennis Schuman says

what do you mean by “self insurance” on your vehicles?

On cars that were older, I didn’t pay for comprehensive insurance so I was “self insuring” (meaning I pay if there’s a claim) against problems.

Ally says

Lots of good gems in here – Reciprocity, automation and spotlight effect really resonated with me. I’m trying to embrace the “stealth wealth” philosophy. The longer I’m on a “finally FI” journey, the easier it gets. Great article!