When I graduated college as a Computer Science major in the winter of 2001, I had to deal with one of the worst job markets in technology. I dealt with it by going back to school, completing a 1-year Masters program, and delay the job search by one year.

My already large student loan balance grew even larger. To be honest, I barely felt it because it was deferred and what’s the difference between a massive number and an even more massive number? I couldn’t wrap my head around it.

Fast forward a few years and the problem for my fellow college graduates is much worse.

My cost of attending Carnegie Mellon University was around $35,000 a year. It’s close to $70,000 now, once you factor in tuition, fees, room & board, books & supplies, etc.

That’s absolutely astounding.

If you’re battling student loans right now and you are having trouble understanding the different student loan forgiveness programs, I’m here to help.

This guide does NOT cover the Biden $10,000 forgiveness plan, which is making its way through the courts. Please read the linked post to get caught up to speed on that!

I’ve enlisted the help of my friend Travis Hornsby, who runs Student Loan Planner, to help walk you through conquering your student loans. He’s just a regular guy who forced himself to learn about student loans because he and his fiancee had $124,000 in student debt. He now offers his knowledge to others for a fee, but we get it free.

Take it away Travis!

Table of Contents

- How Student Debt is Different

- It is difficult to get student loan debt discharged in bankruptcy.

- Some student loans have special forgiveness options.

- The government originates most student loans.

- You can’t approach student loan debt like other debts.

- About the PAYE and REPAYE Programs

- A REPAYE/PAYE/IBR Comparison

- Simple Situations Aren’t Real Life Situations

- What if You Work in a Not for Profit or the Government?

- The Sprint Approach: Get out of Debt as Fast as You Can

- Pick a Plan That Works for You

- Get an Expert Plan for Your Six Figure Student Debt

===============================================

At $1.4 trillion in student debt and counting, there’s a very good chance that you or someone you know owes money for school.

The average debt for the class of 2017 is ~$37,000. Just your run of the mill entry-level Mercedes!

If you went to grad school, you could find yourself owing more than some people’s mortgage.

Law or medical school? Ha. A house and a few cars in the garage!

Regardless of how much you owe, it’s easy to make mistakes when it comes to your student loans. The programs are complicated, the terms are complicated, and the number is just so big.

Don’t worry, I’m here to help you demystify the whole thing.

There are two paths:

- Pay until you reach Loan Forgiveness, or,

- Pay it off entirely as quickly as possible.

Your choice depends on your debt, your income, your employer, and several other factors.

It can be complicated but we’ll get through it.

How Student Debt is Different

First, it’s important to understand that student loan debt is not treated the same as other unsecured debt.

It is difficult to get student loan debt discharged in bankruptcy.

When you have $10,000 of credit card debt, there’s no federal program coming to your rescue. You just slowly pay it back.

If the balance gets so big that you can’t make the payments, then you are forced to declare bankruptcy or settle the debt. Both are bad for your credit but you have an out.

Not so with student loans. A student loan is technically is unsecured and Congress made it virtually impossible to discharge student loans in a bankruptcy court.

If you can’t make the payments, you’re in trouble. The only thing most people accomplish with delinquent student loan payments is accruing additional fees and interest.

Some student loans have special forgiveness options.

Does that mean you’re trapped forever? Fortunately no.

Some student loans have special forgiveness options. If you work in the private sector, you can pay based on your income for 20-25 years and get forgiveness at the end of the period. Your debt is discharged but you must pay tax on the amount forgiven as income.

If you work in the public sector (a not-for-profit 501c3 or government organization qualifies), you only need to make payments for 10 years based on income. Furthermore, that benefit is tax-free.

The government originates most student loans.

They charge relatively high-interest rates of 5% to 8% depending on the program. For high-income borrowers, student loan interest is set far too high compared with what they’d pay in the private markets. For low-income borrowers, the rates are far lower than what they would pay.

This creates a huge market inefficiency. It’s why private refinancing is so popular with the high-income crowd (the generous cashback offers are another good reason). After all, if you could cut your interest rate, why not? Also, the borrowers who might not make salaries high enough to comfortably repay their loans have the benefit of keeping their debt on the federal system.

You can’t approach student loan debt like other debts.

You can see how student debt doesn’t behave like other debt.

With a credit card, “cut your spending and pay it back” is the best advice. With student loans, you might want to refinance that loan. You might not. The math will tell you.

Let’s go with a simple example — people often say to me – “I want to keep my loans with the government even though they charge me 7% because of the better protections.”

Protections are nice but you may be overpaying.

What’s an indication you might be on the wrong repayment plan? If you’re using the Graduated, Extended, or 10-year Standard plans, you need to do the math.

Let’s compare a $50,000 10-year private refinancing deal at 5% to a 25-year federal Extended plan at 7%.

| Plan | Total Cost | Final Year of Repayment | Monthly Payment |

|---|---|---|---|

| Standard 10-Year | $62,039 | 2027 | $530 |

| Extended Plan | $89,054 | 2042 | $353 |

| Difference | $24,015 |

If you’re paying on the federal Extended plan, it’s better to refinance, tighten the belt and make the larger payments to finish in 10 years.

If you can’t make those payments, you shouldn’t refinance but get on an income-driven repayment plan.

About the PAYE and REPAYE Programs

When you’re picking a student loan repayment plan, your baseline is the Standard 10-year refinanced loan.

If that monthly payment amount is too high, you’re a good candidate for keeping your loans as they are to reach forgiveness in the future.

Let’s focus this discussion on folks in the private sector (since different rules apply for 501c3 / government). We’ll get to not for profit/government employees shortly.

$100,000 of student loans & make $40,000 a year

Someone under the Standard 10-year plan would be paying $1,000 a month for 10 years. It’s practically impossible.

Under an income-driven plan, which would likely be the Pay As You Earn (PAYE) or Revised Pay As You Earn (REPAYE) programs, they pay only 10% of “discretionary income.”

At an annual salary of $40,000, that amounts to ~$185 a month. The government calculates the 10% on the income above what you need to live a bare bones lifestyle.

The choice seems clear – You could pay $1,000 a month, or you could pay $185 a month. That’s a huge difference.

What’s the risk in PAYE/REPAYE? There are a few:

- If you earn a higher income in the future, your payments would increase since payments are tied to income. If you earned a lot more, you could end up paying off the loans in full! (thus not taking advantage of the forgiveness provisions but still paying a higher interest rate)

- Forgiveness is not tax-free – when you work in the private sector, you pay taxes on the forgiven debt as if it were income. This tax is paid as a lump sum after the 20-25 year repayment period (in the year the loan is forgiven).

- While your payment towards the loan will be lower, you need to save for this balloon payment in 20-25 years. The money needs to be accessible so I suggest low-cost index funds at Vanguard or Fidelity.

When you owe this huge amount of money in a couple decades, you’ll have enough to write the check just in case. After 20-25 years of saving $200-$1000 a month in index funds, you’ll have a six-figure sum that you can withdraw. You’ll owe a bit of taxes, but you will not have to worry about not being able to cover the “tax bomb” of private sector loan forgiveness.

It’s all about protecting your downside risk with this strategy so you can live life.

A REPAYE/PAYE/IBR Comparison

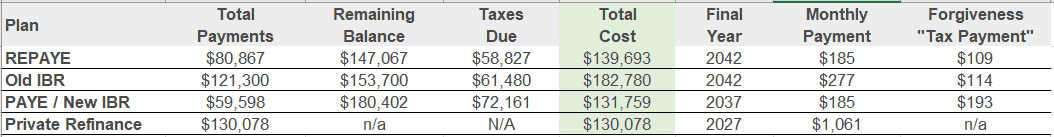

Let’s assume the borrower owes $100,000 at 7% interest, earns $40,000 a year, and will get 3% inflation level increases.

For simplicity, he remains single and doesn’t have children. We also assume a 40% tax rate on the forgiven balance and a private refinancing alternative of 10 years at 5%.

(click to enlarge)

That’s a lot of numbers, so what do they mean:

- Total Payments – This is the total amount of money the borrower will pay over the life of the loan.

- Remaining Balance – The balance on the loan when it is forgiven.

- Taxes Due – The “tax bomb” due in final year.

- Final Year – The year in which the loan is forgiven (assuming you started in 2017)

- Monthly Payment – Your monthly payments to the loan servicer

- Forgiveness Tax Payment – The amount per month you need to save for the eventual tax bomb when the debt is forgiven.

Some things to note when you look at this table:

- PAYE is a 20-year program and REPAYE and IBR are 25-year programs. That’s why the final year of REPAYE is 2042 whereas the final year of PAYE is 2037. Private refinancing is 10 years, based on our assumptions, so it ends in 2027.

- The monthly payment is not the final number for the programs with forgiveness (private refinance doesn’t forgive, hence no tax payment), you still owe the Taxes Due column and thus need to account for that in the savings.

- In 2042, the borrower will owe taxes of $58,827 because his remaining balance of $147,067 will have been discharged. In reality, it might be lower but 40% is a very safe estimate (it’s unlikely to be more than that).

The decision on what to do is tricky because you have several mitigating factors.

The borrower could choose REPAYE because the longer 25-year repayment schedule allows him more time to save for the tax bomb. REPAYE also has interest subsidies, so the amount forgiven is usually less than with PAYE.

Notice that IBR costs more than REPAYE and it’s over the same timeframe. If you’re using IBR, you probably need to get off of it.

Assuming the borrower chooses PAYE, he needs to save for the tax penalty in 20 years. That figure according to the calculations is $193 a month, so round up and say $200 / mont. Put that sum every month into a mutual fund account with Vanguard and you’ll almost certainly have what you need to pay the $72,000 in taxes at forgiveness.

Simple Situations Aren’t Real Life Situations

In the previous comparison, we had someone making $40,000, single, no kids – for the next 20-25 years.

How likely is that? 🙂

When considering private sector forgiveness, will your future household income make that the best choice? The government counts your spouse’s income in your monthly payment calculation.

If you meet that special someone, do you want to have to hold off on marriage because it would mess up your student loan plans?

You could get married, file taxes separately and possibly reduce your payment… but married filing separate has its own penalties that could offset the savings.

If your spouse has no student debt and makes a solid income, loan forgiveness will not look as attractive as you think.

If that spouse has significant student debt, then you likely want to be using the same strategy. That way the government will forgive your loans in the same year approximately.

Assuming your household income puts you well below a 2 to 1 debt to income ratio, then refinancing is probably the right way to go.

What if You Work in a Not for Profit or the Government?

If you have the good fortune to be a full-time employee at a 501c3 or government organization, you might qualify to have your balance forgiven tax-free after just 10 years of income-driven payments.

That means you use the REPAYE / PAYE payment plan for 10 years… then poof, the loan goes away. And the IRS doesn’t send a bill.

It’s known as Public Service Loan Forgiveness (PSLF) and you must have Federal Direct Loans to get this. Anything else will not cut it. (PSLF is managed through FedLoan Servicing)

Most everything issued after 2010 is a Federal Direct loan. Before that, you probably have something called an FFEL loan. To find out if you qualify, send this completed form to the address on the document.

It will take a couple months, but you will find out how much credit you might have already and what to do to get the clock started on tax-free loan forgiveness.

To use the earlier example, what if the borrower with $40,000 income and $100,000 debt worked in a 501c3 non-profit? Here’s the cost below.

| Plan | Total Payments | Remaining Balance | Taxes Due | Total Cost | Final Year |

|---|---|---|---|---|---|

| REPAYE | $25,427 | $144,573 | $0 | $25,427 | 2027 |

Recall that the PAYE cost from the previous example was around $131,000.

Essentially, PSLF amounts to a huge phantom bonus to heavily indebted public servants with modest incomes.

You might have heard some talk about repealing this program. While it could happen, you want to set your finances up to take advantage of it. Even if the repeal chances are 50 / 50, which I do not believe they are, taking the chance that you pay a little bit extra in interest is worth it.

The Sprint Approach: Get out of Debt as Fast as You Can

What if you owe significantly less than double your household income and these programs don’t work for you?

You want to find the lowest interest rate possible and the shortest term you can comfortably afford. Most lenders offer choices between 5, 7, 10, 15, and 20-year options.

Like most loans, the longer the term, the smaller the payment and higher the interest rate.

Deals change all the time because interest rates change. Most borrowers with solid incomes and credit scores above 650 could cut their stated interest rate by 1% to 2%. Sometimes you can even get it down to something that starts with a 3 in the current rate environment.

The other big decision when refinancing is the choice between a variable or fixed interest rate. The variable is typically the better choice if you could easily afford to pay back the debt in less than three years if you had to.

If rates did increase, you could make more prepayments and eliminate the risk that the interest charges go higher. If rates stay roughly unchanged, then you could save as much as 1% on average compared to the fixed option.

I find that most borrowers who refinance like the comfort of a fixed interest rate. When shopping, make sure you consider offers from multiple lenders, or else you could sign up for a significantly higher rate than if you looked around.

DO YOUR HOMEWORK.

Don’t just go with the first company you see in your Facebook feed – the difference between a 6% interest rate and a 5% interest rate is huge. On a $100,000 loan, over ten years, that’s about $6,000.

Pick a Plan That Works for You

If you owe a huge amount relative to what you earn, then going for loan forgiveness can make a lot of sense.

Pick the REPAYE or PAYE plan that allows you to pay only 10% of your income. In 20-25 years, be ready to pay a tax penalty on the forgiven amount and save a few hundred a month to do so.

If you’re in the public sector, make sure you get every dollar of savings with the PSLF program. After all, you’ll have a hard time beating a projected negative interest rate from tax-free loan forgiveness.

If you have the capacity to pay back your loans and the math makes sense, then refinance to the lowest interest rate you can find. Live below your means and try to get out of debt in 5-7 years. Then throw a really not frugal party to celebrate when you make your last payment.

If you feel like your situation is especially complicated, consider getting help with your student debt.

Most folks make a ton of student loan repayment mistakes. If you follow the tips in this article, you’ll be in charge of your finances on a path towards financial independence from student loans.

===============================================

Get an Expert Plan for Your Six Figure Student Debt

If you’re not sure if you should should go for forgiveness or refinancing, owe a bunch relative to your income, and don’t know if you should file jointly or separately for taxes, Student Loan Planner can help. Use that page to book and you get an extra six months of support via email at no additional cost. If you’re already convinced, here’s the booking link.

PS If you wanted a free copy of the calculator that he used to do all the calculations in this article, you can get that here to model your own loans. It’s free.

Shivam Sahu says

Hi Jim,

Another mistake I see people making is deferring loans by continuing with higher education.

Yes, your loans can be deferred while you’re working on a graduate or doctorate degree, but they are still incurring interest, and you’re probably taking out new loans for the higher degree, which just adds to your overall debt.

So not worth it unless you have a very specific career plan that requires a higher degree. This post is very much helpful and a lot of students didn’t know where they are getting themselves into and then regret it afterwards.

Hopefully more students would be able to reach this post for them to be reminded. Thank you for sharing this list!