The internet, and your office watercooler (what an anachronism!), is littered with stories about how so and so made a bundle selling their home or some hot stock investment.

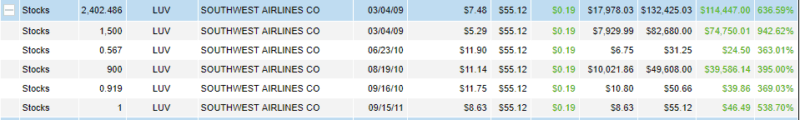

Just the other day, I was talking to a reporter about how my holdings in Southwest Airlines are up 637% over the like 7-8 years. That first slug of shares, 1500 shares at $5.29, is up nearly 950%!

What the internet doesn't have a lot of are stories of investing failures.

(I must enjoy writing about my failures because this is my second list of failures!)

We all have them, but few people talk about them because they're not sexy. In our social media driven world fueled with highlight reels, lowlights have no place.

But every success is coupled with many failures.

Failures are bad outcomes on the path to success. We can learn a lot from them. And you can learn a lot from mine, without the financial pain. 🙂

I don't name the investments and do my best to avoid giving too much detail – you have likely never heard of any of these companies or individuals. The point isn't to shame anyone, I invested my own money with my eyes open and things happen, the point is to learn from my mistakes. The money is gone but I'm still here with the same brain making the same decisions.

Here are the TK lessons I've learned from my many failures:

Failure is Part of the Process

One of the reasons I invested in a variety of areas is to diversify. The stock market is a fantastic way to invest but it goes up and down so easily based on things unconnected to the underlying investments. Diversification is about making a group of uncorrelated bets.

“Do not invest your 401(k) in company stock.”

Your job and primary source of income should be diversified from your retirement savings.

If your company is doing well, you probably won't be fired. If your company is doing poorly, you might be fired. If your company is doing poorly and you're fired, your 401(k) holdings will probably go down too since the company is doing badly. Those two bets are correlated… and that's bad.

“Invest X% of your portfolio in stocks, where X is 120 minus your age.” is another famous rule of thumb. You want to take on some risk (volatility) but not too much relative to your age. As you near retirement, you want less volatility because you'll need to cash out the holdings.

When you allocate your investable assets, you don't want 100% to be in the stock market. You might mix it up and put some in real estate, some in private placements, and some others in even more exotic vehicles. (you can get started in real estate with less than $1,000)

Failure in some is to be expected because you can't bat 100% across a variety of asset classes.

Heck, you can't bat 100% within an asset class (like U.S. equities). You have to expect a little bit of failure to get the wins and if you can't handle overt failure, you should just take the tiny ~1% savings interest rate and let your money lose purchasing power to inflation.

Does that mean you should invest in art? Or whisky? (both are considered collectibles)

Your Deals Probably Suck

I'm not a well-connected investor. Awesome deals do not come to me because all I really offer is money. Maybe some expertise, but mostly money.

In fact, I've turned down several deals in which I would be the last slug of money into an investment. I've learned that “We only have $20,000 left of our $250,000 raise” should be seen as “We can't find this very last bit” rather than “Hurry up before it closes!” (scarcity, anyone?)

I'm like the backup date to the prom!

If you get an investment from one of a well-respected, well-connected VC firm then you get access to a lot more than money. You get access to their network, of important people and other companies. You get access to funding, with more to follow if you're doing well. And you get notoriety because a VC invested in you.

Friends and family rounds are no more than lottery tickets. Very expensive lottery tickets.

I go into greater detail as to I don't like angel investing.

Communication is Key

My biggest financial failure, about $50,000, came at the hands of an inexperienced founder with a cool technology.

The most frustrating part about this experience was that the founder stopped returning phone calls and replying to emails. He kept going on with his life, joining another company, and never even acknowledged the end of the one I invested in. I invested with other folks, some of which know him personally, and even they are surprised at his behavior.

The biggest mistake I made was believing the hype, falling in love with the product/service, and investing in an inexperienced founder.

The founder told me that he was close to a partnership with another large technology company, but that the documents were in the works, and the investment was a bridge round to get him to the deal. I don't think he lied to me but things just kept getting delayed. The deal got farther and farther away but I bought into the hype.

When things fell apart, communications were slow and I didn't push the issue. I didn't pick up the phone to call and figure it out, if there was anything to figure out. But by then it was pretty much dead.

Fortunately, I've reversed this on another investment. I've invested smaller sums in various websites primarily operated by other people in subject areas I wasn't an expert. None have been complete losses, most have returned 90% to all of my original capital but it's taken years for those stories to conclude… which is an opportunity cost.

The key is that with many of these, I made it a point to ensure communication was better. It didn't necessarily change the financial outcome, the story has yet to be written for many of them, but at least I had a better understanding of where things are going. Investments can go bad but you want to see it coming.

If I put in $10,000 and I'm going to lose it, I want to know a little bit ahead of time. Not the day before.

I'm an Executor, Not an Investor

In the years I wasn't running a personal finance blog, I had a part in three different companies. One quietly shuttered (it was way before its time), one was sold, and one is still in operation doing well.

I've come to the realization I'm a decent executor and a poor analyzer of investments. You have to play to your strengths. My investing goals are now to build up companies, establish a team to operate it, and then move onto the next project when it was time.

What's most telling about this realization is that for all other skills I'm bad at, I look to improve it. I try to learn how to become better at it.

With investing, the goal isn't to “be a better investor.” It's to make money. In investing, there are a million ways to make money and there are plenty of skills to improve within that category. Becoming a better analyzer is just one step and with so many different skills, there are other ones I can focus on where I'm already further along.

Beware Who You Trust

When you invest in someone else, you're trusted them to be a steward of your money. Here's the catch… no one washes a rental car. They didn't bleed for that money. They just had to give a presentation and convince you to give it to them. They don't value your money like they value money they earned or that they borrowed from their family.

If the deal goes south, they can walk away because there are plenty of investors out there.

That earlier deal with the startup is a perfect example. I had a deal with a startup that had a promising technology. It was promising until it wasn't and now it's impossible to get even a final K-1 to close that chapter of my investing career.

Don't Take It Personally

It's just money.

When you put it into the stock market and it goes down, there's no one person to blame. So you rarely take it personally.

When you invest in a company, someone asked you for it. That person is the face of that deal. The person who introduced you to the deal may feel personally responsible (even if they have no professional / actual responsibility). It's easy to feel a certain type of way… but don't.

The startup CEO or company founder didn't think he or she would fail. He certainly did not want to fail. He did not want to borrow someone else's money, blow through it, and shut down his company. That's just what happened.

If you want to blame someone, blame yourself! You wrote the check. Once you give someone money, it's not your money anymore.

Double Down on What You Know

What you're reading right now, Wallet Hacks, represents my biggest investment – it takes up my time. Blogs are notoriously cheap to start but they take a lot of time.

As you may or may not know, Wallet Hacks is my second personal finance blog. The first one turned out so well that it changed the trajectory of my life. I'm doubling down… plus I really enjoy it. 🙂

Your time represents your biggest asset. Once you spend it, it's gone. So while I don't like how some of my investments have turned out, there are other opportunities for me to make it back.

When I invest my time, that should free up time in the future (i.e. retirement!) or it's an investment failure I can never recoup.

That's the greatest failure.

William Smith says

Appreciate your honesty and transparency in this article!

Thanks William!

Tawcan says

That’s a nice gain on Southwest!

You’re very right, failure is part of the process. I certainly made some poor investment decisions in the past and have learned from them. Probably will continue making some mistakes here and there, and that’s OK, as long as I’m learning from them and don’t make the same mistakes again.

GYM says

So impressed with your LUV buy! $50,000 is a lot of money, sorry that you invested in something that didn’t turn out to be a good investment and thanks for sharing your experience.

This is my second blog too but I’m not seeing the results I did with my first blog lol (and even then it paled in comparison to your first blog!). I must learn from you… 🙂

Blogging takes up a lot of time- that’s for sure!

Tammy says

Thank you so much for sharing such Great, valuable information. You have given me much to think about and consider where as I would have failed to do. Never overlook what’s in front of you, no matter how minor and always cover your butt ( cross your T’s and dot those I’s). Once again Thank you and God bless you!