Mint shut down on March 23, 2024.

For years, I’d used Mint in my early to mid-twenties to help me manage spending. Budgeting is a critical component of responsible money management, and Mint made it easy.

Over the years, I focused more on investing and wealth building (but still keeping a budget, just not spending as much time on it) and turned to other tools as I “matured” financially.

I was still surprised when I got the email that Mint decided to shut down and migrate folks to Credit Karma.

I’ve long enjoyed Credit Karma because they offered legitimately free credit scores. You can contend with the advertisements, but I was OK with that; companies need to make money so they can continue to offer free products and services. It’s how Mint kept the lights on… until, I suppose, it wasn’t doing well enough.

The big question for many users was where they would go. Mint suggested Credit Karma, their sister brand/company, but I was skeptical. Since Mint was founded and acquired by Intuit, many Mint alternatives are available.

You have a lot of options.

But one option that should be considered is making that migration. If it’s seamless and offers the same services as Mint, it seems like a no-brainer, especially since Credit Karma is free.

I finally got the email from Mint that I can now migrate to Credit Karma – and it was pretty easy (but not really worth doing yet, unfortunately).

📔 Quick Summary: You can transfer your data from Mint to Credit Karma but don’t. Credit Karma is NOT a good alternative to Mint – the budgeting features are just too basic and nothing close to what Mint offers.

You can download your Mint transactions and see for yourself (once you migrate, your Mint information is gone) but I was disappointed. It seems that the two leading contenders for a budgeting alternative are Simplifi by Quicken and Monarch Money (MINT50 gets you 50% off) – unfortunately both are paid services but they’re affordable and worth it.

Empower Personal Dashboard is OK at budgeting, but it’s free. It’s better at net worth tracking and retirement planning. Nerdwallet’s budgeting tool is also free but very basic – might be worth a quick look but it needs to improve a lot more to be a true replacement. (here are the best free budgeting apps, it’s a short list)

Table of Contents

How to Migrate from Mint to Credit Karma

You can’t migrate until you get an email (or log into your account and see the option) from Intuit.

I received an email with the SUBJECT: You can now move your Mint history to Credit Karma.

First things first, DOWNLOAD YOUR TRANSACTIONS! (here are the instructions)

Once you migrate, they shut down your Mint account and you can no longer get access to it. You want to download your transactions in case Credit Karma isn’t a good fit and you want to import that data to another app.

Next, click the orange button in the email, and you’ll get prompted to log into Credit Karma.

Click this obvious button:

Once you click, you’ll be shown a modal pop-up with what you’ll get and another small, warning that once you migrate, you lose Mint forever. Click with trepidation. 🙂

You’ll be prompted to log into Credit Karma:

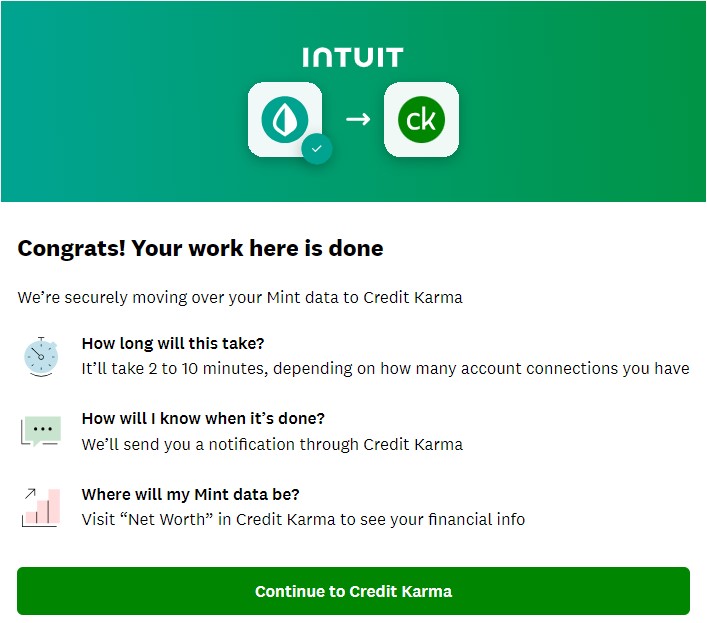

And in a few minutes, boom, you get this happy screen:

Mint Features in Credit Karma

I would not go as far as to call Credit Karma a budgeting tool.

As of February 24th, I don’t see many Mint features within Credit Karma (outside of what existed before the Mint closure announcement). You have the Net Worth tools that Credit Karma announced earlier in 2023.

There are some very light budgeting tools, like categorization of your spending and a look at cash flow, but it’s pretty basic.

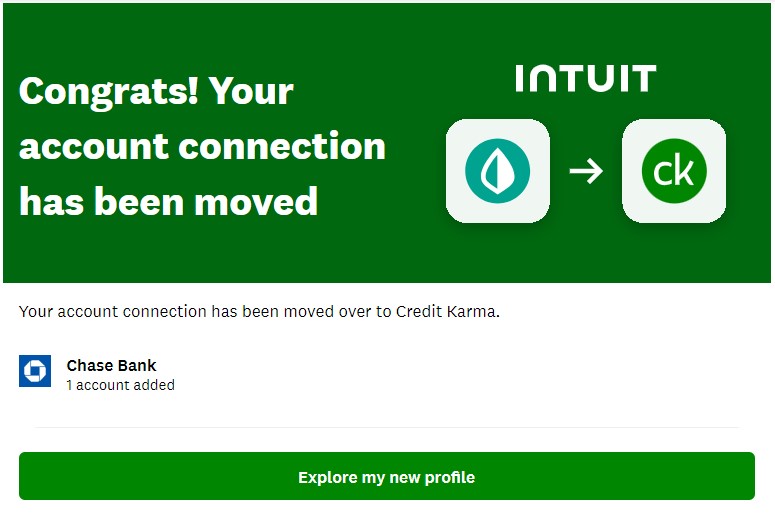

For example, here’s what they show as my “December top spending:”

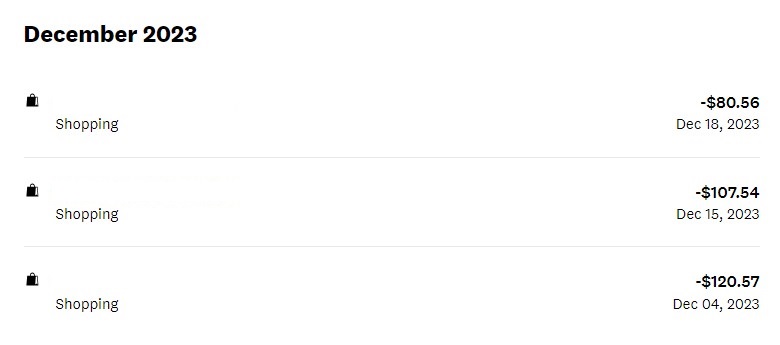

You can click through to “Shopping” and see a list of my expenses:

You can edit the expense and change the category to one of 26 other categories, but that’s it. You can’t split anything, so that charge at the gas station is all gas, even if you spent a little in the food mart.

You can’t rename or add expense categories. You can’t rename the expense to something more readable either; it’s just whatever appears on the credit card statement.

Credit Karma is Not Mint (Yet?)

It’s still early (Mint doesn’t shut down until March 2024), but don’t migrate to Credit Karma if you think it will give you the Mint experience.

It’s not.

It’s very far from Mint, so if you migrate now, you will be in shock.

I think it will take a few months for various features to get pulled into Mint (if Intuit is serious about Credit Karma being a Mint successor), but if this is its final form, you need to look elsewhere.

⏰ Quick update for February 2024 – the original post was written in early January and I just logged back into Credit Karma (late February) and it looks pretty much the same as back then. Not much has changed in the last month or so, which is not a great development.

Mint Alternatives

If you don’t want to wait or want to get a head start, here are some excellent Mint alternatives. You can always migrate later, and many of the other options offer promotions for Mint escapees.

If you’ve graduated from budgeting, my vote goes to Empower Personal Dashboard (formerly Personal Capital) because they offer some light budgeting tools (better than what Credit Karma offers right now) but a rich suite of investment and wealth-building tools. Our Empower review goes into greater detail.

Simplifi by Quicken is very similar to Mint and might be one of the more popular options for those looking to move. The big difference is that it’s not free; the regular price is $4 a month, but they’re running promotions right now for folks making a switch. There’s a 30-day money-back guarantee, so you can try it out to see if it works.

Also, here’s an analysis of Credit Karma vs Simplifi, if you are considering it.

Monarch Money is another alternative that is billing itself as the best Mint alternative – there’s a 30-day trial period so you can try it out to see if they’re right. Monarch Money costs $14.99 per month ($8.33 per month when paid annually). Our full review of Monarch Money can give you more information.

Don Kalen says

Be careful in moving to CK if you are using Mint’s Transaction download option. CK currently has an error regarding Transactions. First CK current instructions directs you back to Mint to download Transactions. However you can’t log into Mint because your password is blocked once you switch to CK. Instead Mint asks you for your phone number and sends a verification code. When you enter the code an a Click to Download Transactions Icon appears and when you click on it you get your Transactions from a frozen date that so far never advances. In my case that’s 12/10/23. I’ve complained a number of times: Case Number: #10629818 and so far all I get as feed back 1s either a suggestion to go back to Mint (no longer possible) and use the Transacton option to get the date range I want, or that “they are looking into it”.

This is good advice, thank you Don!

Craig Ephraim says

I have been running Monarch and Empower for a couple of weeks after deciding that Credit Karma was crap.

I think I prefer Empower over Monarch and here’s why.

Most of my accounts are syncing with Empower and I just read this: “Empower Personal Dashboard updates your accounts once every night (around midnight) and then each time you log into the application, up to once every 4 hours.”

This is true. With Monarch, the updates are less frequent, and you have to force a “Refresh All” when you go in if they haven’t been recently updated. PITA.

Credit Karma sucks, as most of us have decided. Empower is much better. And, it’s free, unlike Monarch. I use it for Net Worth and Transactions mostly, but don’t use it for budgeting, which is better in Monarch.

Other than occasional marketing messages, I think Empower has a nice, clean interface. It also sends emails with daily summaries.