International stock funds have turned in a disappointing performance in recent years, at least when compared with US stocks. But long-term investors understand the importance of diversification, including the need to spread capital into underperforming asset classes. After all, asset classes tend to cycle between gains and losses. Though the S&P 500 has been on a tear for the past dozen years, things could change.

Two popular international stock funds include Vanguard Total International Stock ETF (VXUS) and Vanguard FTSE All-World ex-US ETF (VEU). Both funds are considered foreign large blend funds that invests in large stocks of companies outside the US. Either one can provide the type of exposure you’re looking for if you want to add international stocks to your portfolio.

The question is, which is the better international ETF for your portfolio – VXUS vs. VEU?

Table of Contents

VXUS vs. VEU: Differences in a Nutshell

We go into greater detail below but here’s the skinny:

- Both funds are considered “Foreign Large Blend Funds” – which means they invest in large cap international stocks.

- VXUS has roughly twice the number of stocks as compared to VEU (7500 vs. 3500)

- The stocks that VXUS has that aren’t in VEU tend to be smaller cap stocks

- VXUS has more net assets too, 7.5x more, so it’s more popular now (as measured in dollars)

- VEU is older by about 4 years, so you could interpret that to mean VEU has fallen out of favor

- Both have the same expense ratio of 0.08%

- It is useful from a tax loss harvesting perspective though!

VXUS vs. VEU: How Each One Works

Vanguard Total International Stock ETF (VXUS) and Vanguard FTSE All-World ex-US ETF (VEU) seem like a classic competition between two very similar funds within the Vanguard family. Vanguard has designed each fund to provide broad exposure to international stocks, primarily in Europe, the Pacific, and emerging markets.

The most identifiable difference between the two exchange-traded funds (ETFs) is in each track index. The VXUS tracks the Spliced Total International Stock Index, while VEU is tied to the FTSE All-World ex-US Index.

But even that difference seems to be primarily cosmetic. Both indexes comprise essentially the same companies in the same geographic distribution. And as we’ll see in a moment, nine of the top 10 holdings between the two funds are identical.

VXUS vs. VEU: A Direct Comparison

Basic Information

The table below provides a side-by-side comparison of the basic features of VXUS and VEU. But the basics tend to mask the similarities between the two ETFs.

| Fund Features | VXUS | VEU |

|---|---|---|

| Asset Class | International/Global Stock | International/Global Stock |

| Category | Foreign Large Blend | Foreign Large Blend |

| When Launched | 01/26/2011 | 03/02/2007 |

| Expense Ratio | 0.07% | 0.07% |

| Market Price (as of 6/10/2022) | $54.09 | $52.26 |

| 52-week High / Low Price | $67.48 / $52.60 | $65.21 / $50.90 |

| Total Net Assets | $363.5 billion | $48.6 billion |

| Number of Stocks | 7,881 | 3,656 |

| Dividend Distribution | Quarterly | Quarterly |

The key difference we can see is that VEU is much smaller in terms of net assets, despite being around several years longer, and is invested in less than half the number of securities. Those alone don’t tell much of a story so we need to go a little bit deeper.

VXUS Holdings Breakdown

The international distribution of the VXUS is as follows:

- Europe (39.60%)

- Pacific (26.60%)

- Emerging Markets (25.40%)

- North America (7.90%), and

- Middle East (0.50%).

The ten most significant holdings in the VXUS fund, which represent just 9.2% of total net assets, include:

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Nestle SA

- Samsung Electronics Co. Ltd

- Tencent Holdings Ltd.

- Roche Holdings AG

- ASML Holding NV

- Toyota Motor Corp.

- AstraZeneca plc

- Shell plc

- Novartis AG

VEU Holdings Breakdown

The international distribution of the VEU is as follows

- Europe (40.00%)

- Pacific (27.10%)

- Emerging Markets (25.40%)

- North America (6.90%)

- Middle East (0.50%), and

- Other (0.10%).

Notice that the international distribution of holdings for VEU is almost identical to that of VXUS

The ten largest holdings in the VXUS fund, which represent just 10.5% of total net assets, and look almost identical to VXUS, include:

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Nestle SA

- Samsung Electronics Co. Ltd

- Tencent Holdings Ltd.

- Roche Holdings AG

- ASML Holding NV

- Toyota Motor Corp.

- AstraZeneca plc

- Shell plc

- Novartis AG

The ranking of their holdings are the same. From time to time the bottom of the holdings list will shift around, which indicates that the price of the shares likely have an impact on the rankings more than an actual shift in strategy.

For example, when we first researched this list in May 2022, the only difference between the two funds is that #10 for VXUS is BHP Group Ltd., while Alibaba Group Holding Ltd. holds the same position as VEU.

The only other most identifiable difference as far as holdings between the two funds are that VXUS holds more than twice as many companies as VEU. Practically speaking, that likely means VXUS includes significant exposure to smaller capitalization stocks.

But as we’re about to see, the big difference in the number of holdings between the two funds has had little impact on performance.

Performance

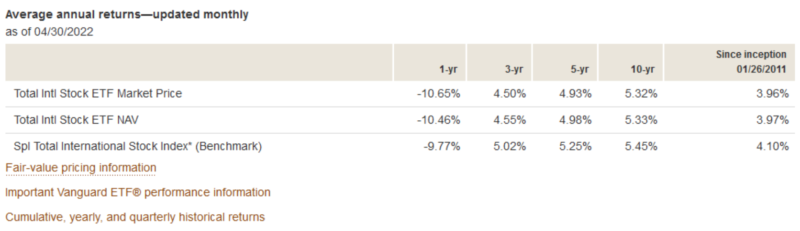

Below are screenshots of both funds’ 1-year, 3-year, 5-year, 10-year, and since inception performances, courtesy of Vanguard.

VXUS:

VEU:

If we could overlay the two screenshots, the performance for each period would be almost identical. Let’s do a side-by-side comparison using a table:

| Performance Period | VXUS | VEU |

|---|---|---|

| 1-Year | -10.65% | -10.79% |

| 3-Year | 4.50% | 4.38% |

| 5-Year | 4.93% | 4.95% |

| 10-Year | 5.45% | 5.24% |

| Since Inception (inception date) | 3.96% (since 01/26/2011) | 3.24% (since 03/02/2007) |

Notice that the differences are very slight for the 1-year, 3-year, and 5-year performances. The only meaningful performance difference is on the 10-year return.

The 5.45% return of the VXUS is 0.21% greater than the 5.24% of the VEU. That’s not a difference that would make you rich, but it would make a noticeable difference compounded over a decade.

It’s worth noting that the two funds were started four years apart. This likely accounts for the performance difference between the two.

Launching in early 2007, VEU would have fully faced the 2007 – 2009 stock market crash. The VXUS would have missed that downturn entirely since the fund didn’t begin until 2011.

One crucial distinction between the VXUS vs. VEU is that VXUS has more than twice as many stocks and includes smaller capitalization stocks. But if this is an advantage, it has yet to show up in the fund’s performance. VXUS slightly underperforms VEU over the past ten years, even with the heavy small cap exposure.

Using VXUS & VEU for Tax Loss Harvesting

If you’ve made it down this far, you might be wondering if there’s some value in having VXUS and VEU available to you – and if you thought “tax loss harvesting!” You’d be right!

The two funds resemble each other very closely but with such a big holding disparity in number of companies (7500 to 3500), they aren’t identical.

And because they aren’t identical, they can be useful for tax loss harvesting. 🙂

VXUS vs. VEU: Is One Better than the Other?

We recently published a head-to-head comparison of two other Vanguard ETFs, VOO and VTI. And as was the case there, it would seem that neither the VXUS nor the VEU is the clear winner. The VEU does have a slightly superior 10-year performance, which swings the pendulum in its favors lightly.

It’s worth noting that VEU holds fewer than half as many companies in its portfolio. The slight 10-year performance advantage may have to do with the concentration in larger companies outperforming the smaller ones. And as discussed earlier, the VXUS concentration in smaller cap stocks has yet to prove any advantage, performance-wise.

The tricky part is getting past how both funds have turned in what can best be considered mediocre performances over the past decade and double-digit losses in the most recent year. But that’s just a reflection of the direction of the global markets.

If you’re planning to invest in either the VXUS or the VEU, you’re betting that global stock market leadership will move outside the US to international markets. Make that decision, and either of these funds may be the right one for you.